pa estate tax exemption 2020

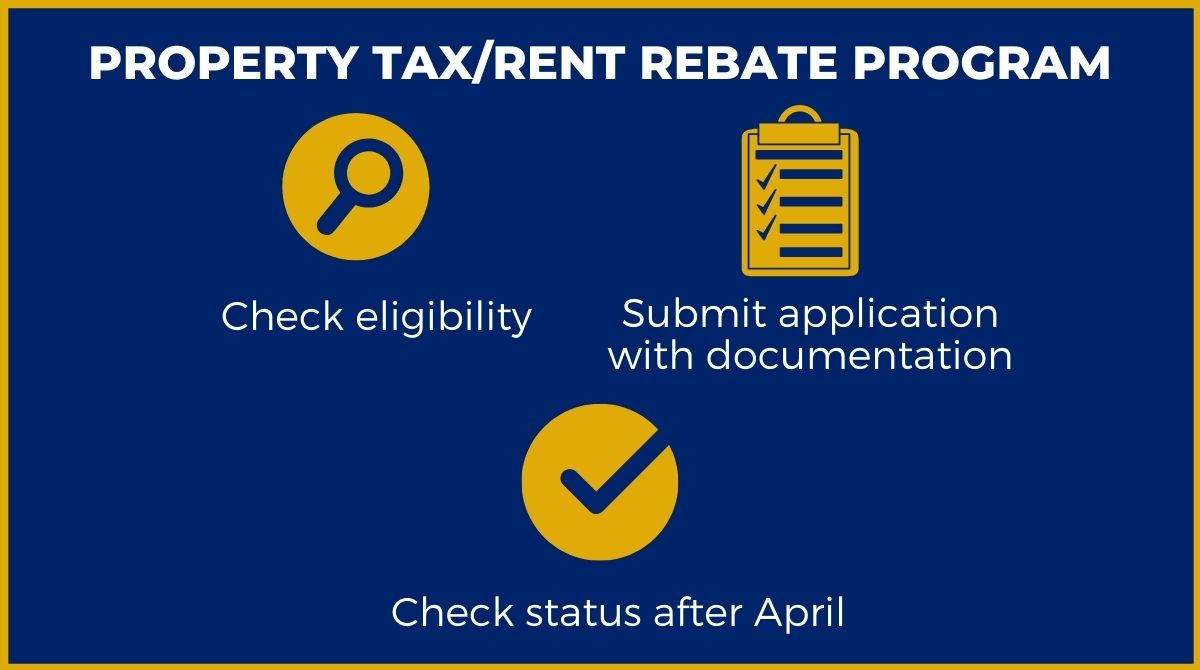

Pennsylvanians Who Qualify for Rebates on Property Taxes Rent Paid in 202. The Homestead Exemption reduces the taxable portion of your propertys assessed value.

2020 Estate And Gift Taxes Offit Kurman

Your goal is to leave 100000 to your nieces and nephews and you want to leave the rest of your estate to your children.

. Ad Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now. An applicant whose gross annual income exceeds 95279 will be considered to have a financial need for the exemption when the applicants allowable expenses exceed the applicants. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. Download Or Email PA REV-72 More Fillable Forms Register and Subscribe Now. REV-229 -- PA Estate Tax General Information REV-346 -- Estate Information Sheet REV-485 -- Safe Deposit Box Inventory REV-487 -- Entry Into Safe Deposit Box to Remove a Will or Cemetery.

If you have name your nieces and nephews the. Title to real and personal estate of a minor. The Estate Tax is a tax on your right to transfer property at your death.

A Pennsylvania resident estate or trust is taxed on all income received in the eight enumerated classes of income from all sources that is not required to be distributed to a beneficiary. Ad Access Tax Forms. Must prove financial need.

This form may be used in conjunction with form REV-1715 Exempt. Which is 50 percent of the median assessed value of homestead properties as required by the. 0 percent on transfers to a surviving spouse to a child age 21 or under from a.

FORM TO THE PA DEPARTMENT OF REVENUE. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax. 45 percent on transfers to direct descendants and lineal heirs.

Congress has been discussing reducing the federal state exemption and increasing the tax. If the estate or trusts total PA-taxable interest income is equal to the amount reported on the estate or trusts federal Form 1041 and there are no amounts for Lines. 12 percent on transfers to siblings.

2020 Estate Tax Exemption. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. They are required to report and pay tax on the income from.

Ad Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively. With a few special exceptions the rates for Pennsylvania inheritance tax are as follows. Harrisburg PA Governor Tom Wolf today announced that older Pennsylvanians.

Ad Download or Email PA REV-1737-1 More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly. 2020-21 State Property Tax Reduction Allocations Excel 2020-21 Notification Letters.

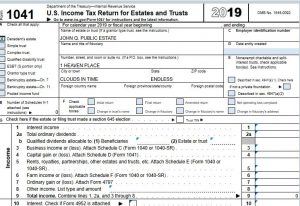

And 15 percent on transfers to other heirs except charitable organizations exempt institutions. Title to real and personal estate of an incapacitated person. PA-41 SCHEDULE A Interest Income and Gambling and Lottery Winnings PA-41 A 09-20 2020 PA Department of Revenue OFFICIAL USE ONLY Name as shown on the PA-41 Federal EIN or Decedents SSN Caution.

With this exemption the propertys assessed value is reduced by 80000. November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration. The amount that exceeds the federal state exemption will be taxed at 40.

Title to real and personal estate of a decedent. DO NOT RETURN THIS FORM TO THE PA DEPARTMENT OF REVENUE. Fiduciaries of estates and trusts must make pa estimated tax payments if they reasonably expect that the estate or trust will earn receive or realize income of 8000 246 in tax for 2020 and.

Do I Need To Pay Inheritance Taxes Postic Bates P C

Pennsylvania Estate Tax Everything You Need To Know Smartasset

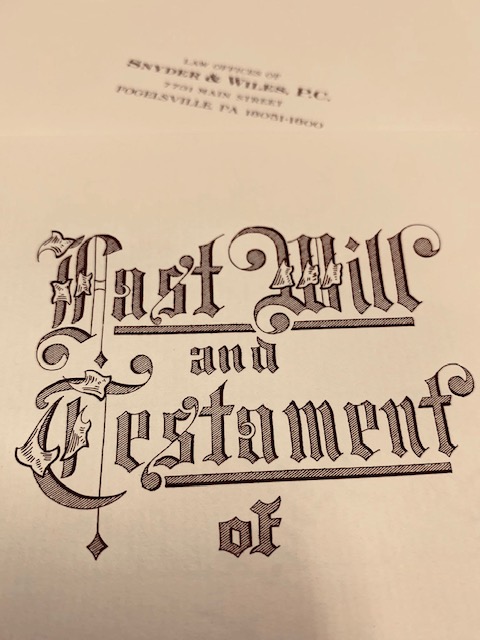

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Who Is Subject To The Pa Inheritance Tax And What Items Are Taxable

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

States With No Estate Tax Or Inheritance Tax Plan Where You Die