omaha ne sales tax calculator

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Ad Lookup Sales Tax Rates For Free.

Property Tax Calculator Property Tax Guide Rethority

Speak Victory Over Your Life Scripture.

. There are no changes to local sales and use tax rates that are effective January 1 2022. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE. Sales Tax State Local Sales Tax on Food.

Nebraska NE Sales Tax Rates by City A The state sales tax rate in Nebraska is 5500. Campos Tax Services Edinburg Tx. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

After 1 is retained by the County Treasurer the distribution of funds collected for the Motor Vehicle Fee are. The Nebraska state sales and use tax rate is 55 055. With local taxes the total sales tax rate is between 5500 and 8000.

The Omaha sales tax rate is 15. The Omaha Nebraska general sales tax rate is 55Depending on the zipcode the sales tax rate of Omaha may vary from 55 to 7 Every 2020 combined rates mentioned above are the results of Nebraska state rate 55 the Omaha tax rate 0 to 15. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Did South Dakota v. Tn Vehicle Sales Tax Calculator Hamilton County. Sweet Life Quotes Images.

Method to calculate Omaha sales tax in 2021. This is the total of state county and city sales tax rates. If this rate has been updated locally please contact us and we will update the sales tax rate for Omaha Nebraska.

How 2020 Sales taxes are calculated in Omaha. Omaha Sales Tax Rates for 2022. The minimum combined 2022 sales tax rate for Omaha Nebraska is 7.

Groceries are exempt from the Omaha and Nebraska state sales taxes. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Interactive Tax Map Unlimited Use.

The December 2020 total local sales tax rate was also 7000. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska has recent rate changes Thu Jul 01 2021.

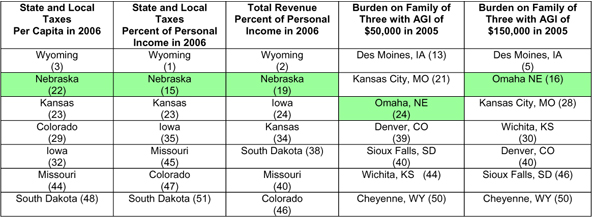

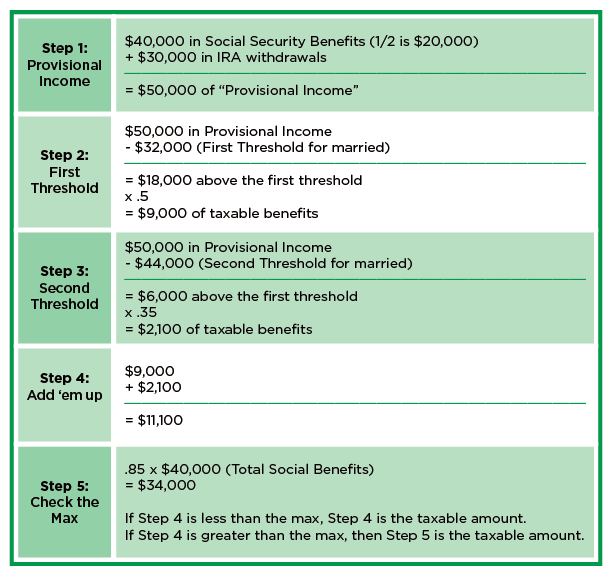

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. 50 to the County Treasurer of each county amounts in the same proportion as the most recent allocation received by each county from the Highway Allocation. There are no changes to local sales and use tax rates that are effective July 1 2022.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. The Nebraska sales tax rate is currently 55.

Nebraska Sales Tax Calculator. The sales tax rate for Omaha was updated for the 2020 tax year this is the current sales tax rate we are using in the Omaha Nebraska Sales Tax Comparison Calculator for 202223. Motor Vehicle Fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5. You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. The County sales tax rate is 0.

Real property tax on median home. The Nebraska NE state sales tax rate is currently 55. The current total local sales tax rate in Omaha NE is 7000.

Omaha Ne Sales Tax Calculator. Nebraska has a 55 statewide sales tax rate but also has 334. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Omaha NE.

The Sales tax rates may differ depending on the type of purchase. Beaufort Sc Restaurants With Outdoor Seating. Nebraska sales tax details.

Omaha in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Omaha totaling 15. Sales tax in Omaha Nebraska is currently 7. You can find more tax rates and allowances for Omaha and Nebraska in the 2022 Nebraska Tax Tables.

Tax Foundation Proposed Tax Rate Increases Undo Impact Of Property Tax Cuts

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Property Tax Calculator Property Tax Guide Rethority

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Taxes And Spending In Nebraska

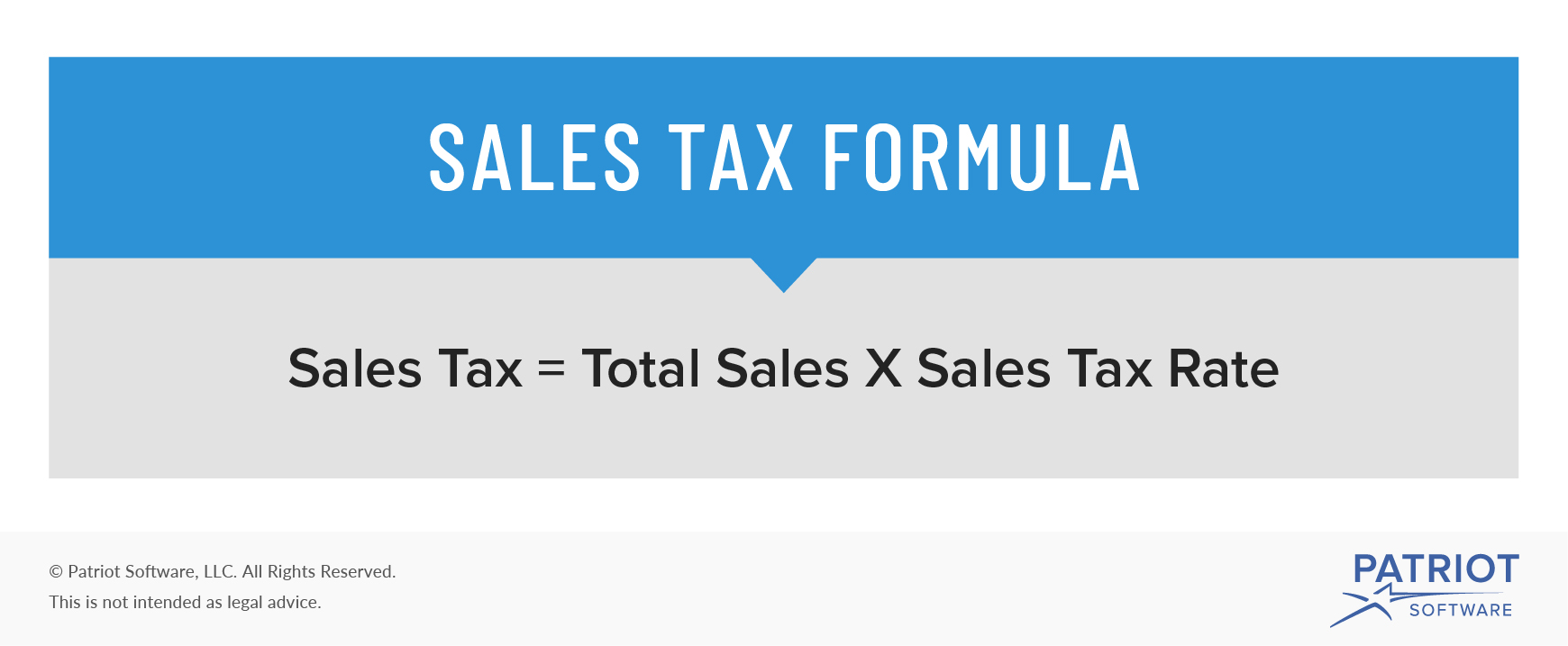

How To Calculate Sales Tax Definition Formula Example

Nebraska Income Tax Calculator Smartasset

Taxable Social Security Calculator

Nebraska Sales Tax Small Business Guide Truic

How To Calculate Sales Tax Definition Formula Example

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

States With Highest And Lowest Sales Tax Rates

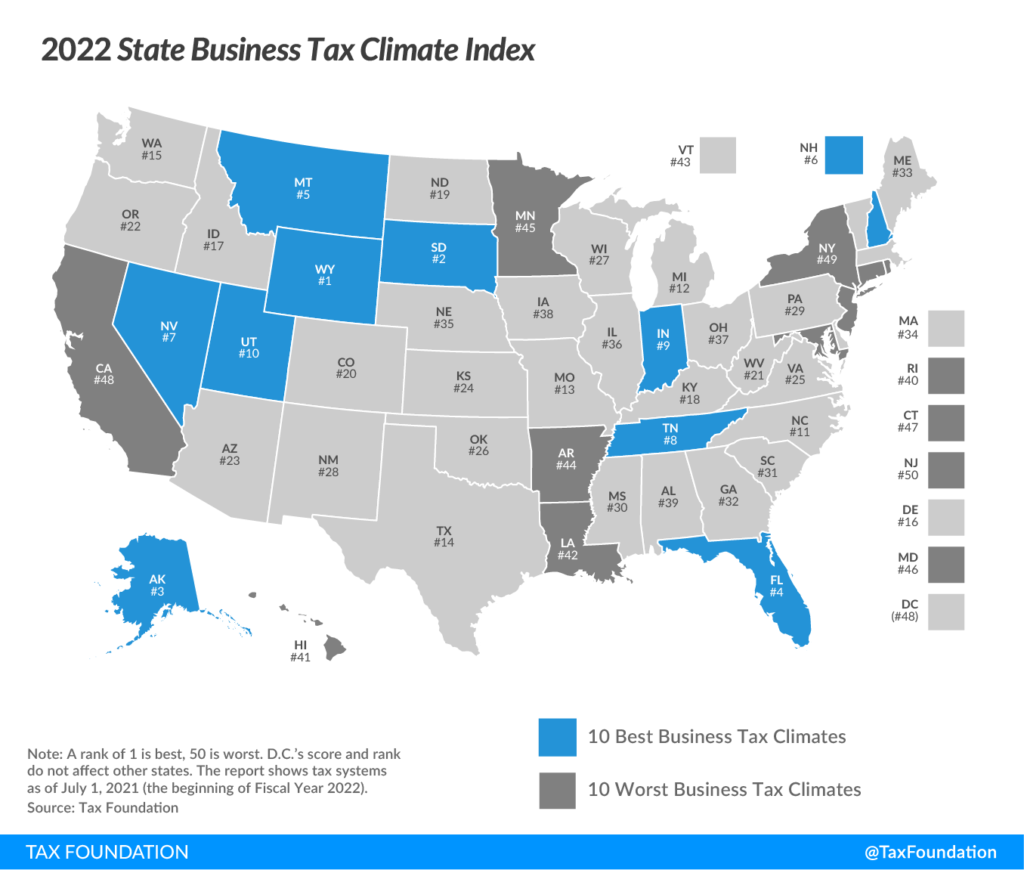

Nebraska Drops To 35th In National Tax Ranking